Insurance is a way to manage risks. But risks evolve. So insurers must evolve too, modernizing systems and decision-making with AI, data, and customer-centric platforms.

Insurance is moving from one-size-fits-all coverage into real-time, personalized protection. To adapt, insurers need smarter ways to process claims, launch digital products, and manage risk at scale.

We help them achieve that with domain-specific tech: AI that flags fraud before it happens, APIs that power embedded insurance, and cloud platforms built for fast, compliant transformation.

Policyholders and new customers can now breeze through a personalized and paperless onboarding experience with our end-to-end automated system, featuring:

From underwriting to claim management, our end-to-end modular core system covers the entire spectrum of the insurance process, including:

All insurance stakeholders have access to dedicated portals designed to enhance their experience and optimize their operational efficiency.

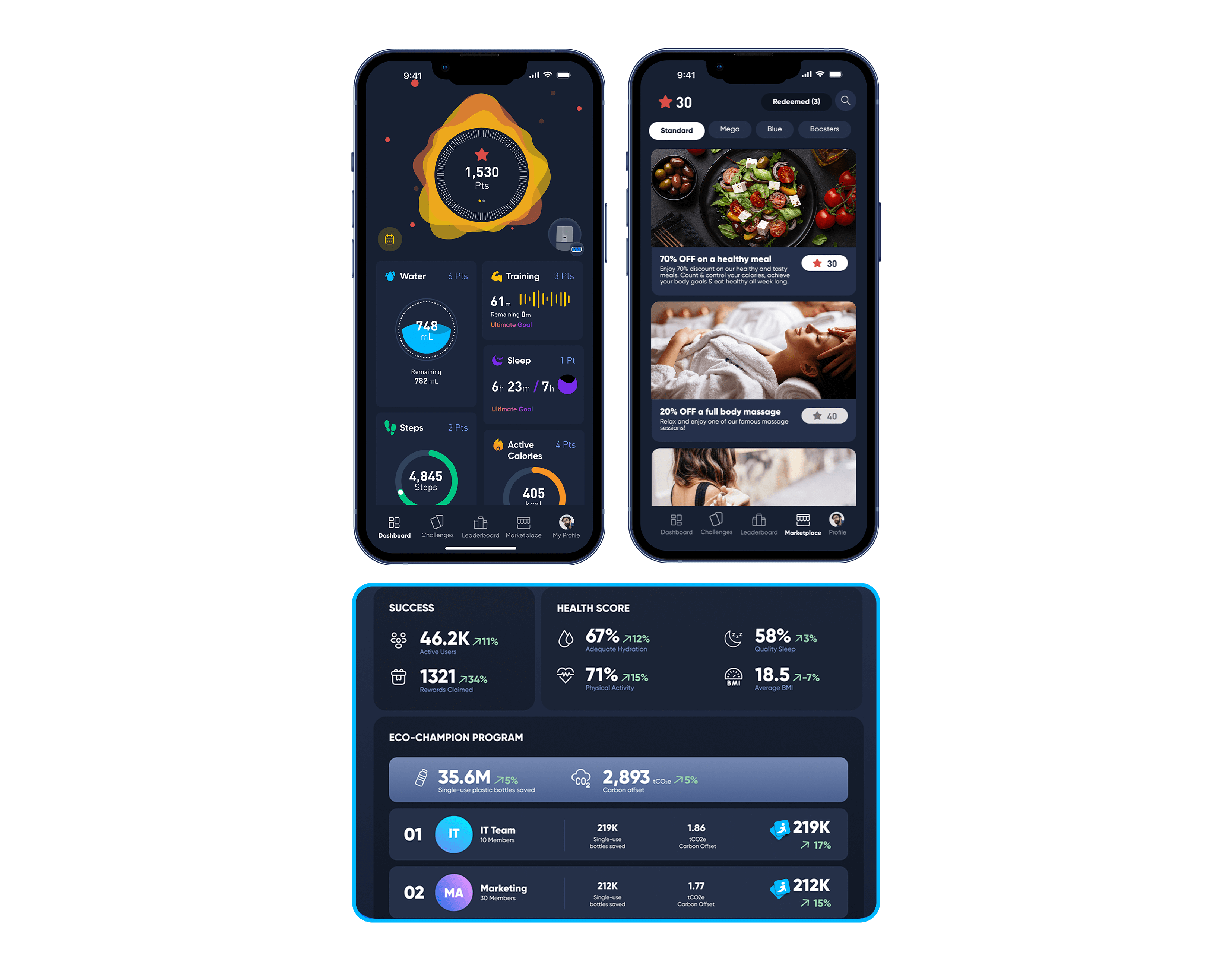

Our wellness management platform supports healthier living by guiding users through the right clinical pathways, like a balanced diet, and breaking down nutrients to fit their personal goals. It also turns vital signs from wearables into actionable health reports and uses gamified micro-habits to make long-term change engaging and measurable.

Legacy systems, static products, and siloed data are being replaced by intelligent platforms built for adaptability, speed, and scale. Insurers that lead with technology are redefining how protection is delivered and how value is created.

A fuel for innovation

Our innovative solutions provide insurers with a robust and flexible foundation that accelerates adaptation to market changes at scale, with a focus on cost-efficiency. By harnessing the power of automation, AI, and data analytics, we help insurers seamlessly execute a two-speed strategy, delivering both operational effectiveness and innovation to meet today’s and tomorrow’s demands with ease.

Services

Integrating modern tech incrementally into active insurance systems ensures operational continuity and process integrity across your organization. Our strategy implies enhancing existing assets and introducing new features within a defined timeline without interrupting any running workflow.

CME’s on-going contributions for a tech-forward insurance future perfectly aligns with the digital landscape’s ever-evolving intricacies. Our comprehensive insurance suite enables insurers to seamlessly interact with market dynamics and purse innovation with ease.

Take a leap into the future, harness the power of innovation and accelerate your transformation to unlock new opportunities.